A joint venture is a legal entity that takes the form of a short term partnership in which the persons jointly undertake a transaction for mutual profit, generally each person contributes assets and share the risks, like a partnership, joint ventures can involve any type of business transaction and the parties can be individuals, group of individuals, companies or corporations.

Joint venture is a legal organization in the nature of a partnership engaged in the joint prosecution of a particular transaction for mutual profit, an association of persons jointly undertaking some commercial enterprise, it requires a community of interest in the performance of the subject matter, a right to direct and govern the policy in connection therewith, and duty, which may be altered by agreement, to share both in profit and loses, unlike a partnership, a joint venture does not entail a continuing relationship among the parties.

Joint ventures are also widely used by companies to gain entrance into foreign markets. Foreign companies form joint ventures with domestic companies already present in markets. The foreign companies generally bring new technologies and business practices into the joint venture, while the domestic companies already have the relationships and requisite governmental documents within the country along with being entrenched in the domestic industry.

Joint Ventures are governed by state Partnership, Contracts, and Commercial Transactions Law. A Joint Venture is also treated like a Partnership for Federal Income Tax purposes. A joint venture corporation involves the same type of activity as above but within a corporate framework. Foreign joint ventures are subject to the International Trade Laws and the laws within the foreign countries.

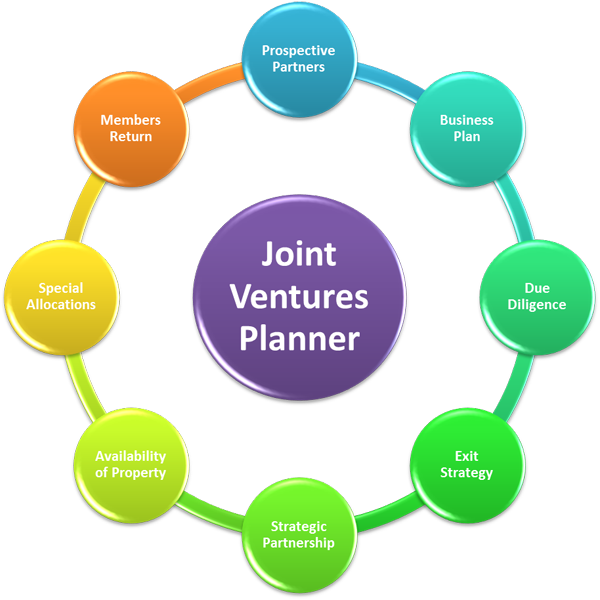

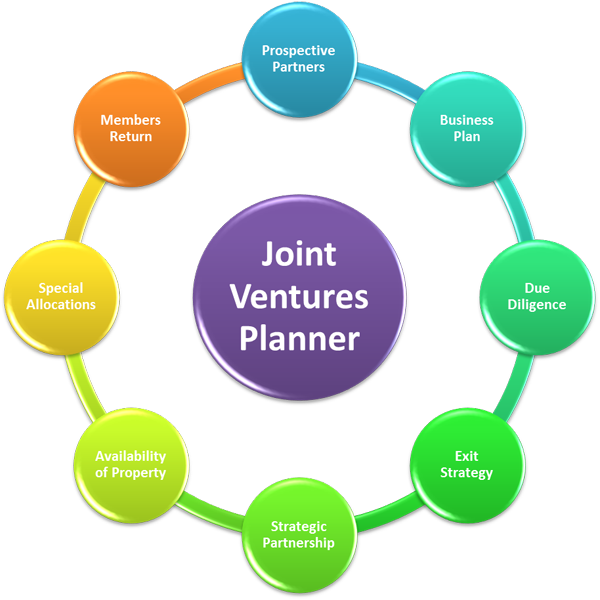

As there are good business and accounting reasons to create a joint venture (JV) with a company that has complementary capabilities and resources, such as distribution channels, technology, or finance. Joint ventures are becoming an increasingly common way for companies to form strategic alliances. In a joint venture, two or more parent companies agree to share capital, technology, human resources, risks and rewards in a formation of a new entity under shared control.

How you set up a joint venture depends on what you are trying to achieve. One option is to agree to co-operate with another business in a limited and specific way. For example, a small business with an exciting new product might want to sell it through a larger company's distribution network. The two partners could agree a contract setting out the terms and conditions of how this would work.

Alternatively, you might want to set up a separate joint venture business, possibly a new company, to handle a particular contract. A joint venture company like this can be a very flexible option. The partners each own shares in the company and agree how it should be managed.

In some circumstances, other options may work better than a limited company. For example, you could form a business partnership or a limited liability partnership. You might even decide to completely merge your two businesses.

Businesses of any size can use joint ventures to strengthen long-term relationships or to collaborate on short-term projects. A successful joint venture can offer:

A joint venture can also be very flexible. For example, a joint venture can have a limited life span and only cover part of what you do, thus limiting the commitment for both parties and the business' exposure.

Partnering with another business can be complex. It takes time and effort to build the right relationship. Problems are likely to arise if:

Success in a joint venture depends on thorough research and analysis of aims and objectives. This should be followed up with effective communication of the business plan to everyone involved.

Setting up a joint venture can represent a major change to your business. However beneficial it may be to your potential for growth, it needs to fit with your overall business strategy. It’s important to review your business strategy before committing to a joint venture. This should help you define what you can realistically expect. In fact, you might decide that there are better ways to achieve your business aims. If you do decide to form a joint venture, it may well help your business to grow faster, increase productivity and generate greater profits. Joint ventures often enable growth without having to borrow funds or look for outside investors. You may also be able to use your joint venture partner's customer database to market your product, or offer your partner's services and products to your existing customers. Joint venture partners also benefit from being able to join forces in purchasing, research and development.

Before starting a joint venture, the parties involved need to understand what they each want from the relationship.

Smaller businesses often want to access a larger partner's resources, such as a strong distribution network, specialist employees and financial resources. The larger business might benefit from working with a more flexible, innovative partner or simply from access to new products or intellectual property.

Similarly, you might decide to build a stronger relationship with a supplier. You might benefit from their knowledge of new technologies and get a better quality of service. The supplier's aim might be to strengthen their business from a guaranteed volume of sales to you.

Whatever your aims, the arrangement needs to be fair to both parties. Any deal should:

The objectives you agree should be turned into a working relationship that encourages teamwork and trust.

The ideal partner in a joint venture is one that has resources, skills and assets that complement your own. The joint venture has to work contractually, but there should also be a good fit between the cultures of the two organizations.

A good starting place is to assess the suitability of existing customers and suppliers with whom you already have a long-term relationship. You could also think about your competitors or other professional associates. Broadly, you need to consider the following:

If you opt to assess a new potential partner, you need to carry out some basic checks:

Selection of a good local partner is the key to the success of any joint venture. Once a partner is selected generally a Memorandum of Understanding or a Letter of Intent is signed by the parties highlighting the basis of the future joint venture agreement.

A Memorandum of Understanding and a Joint Venture Agreement must be signed after consulting lawyers well versed in International Laws and Multi-jurisdictional Laws and Procedures.

Before signing the joint venture agreement, the terms should be thoroughly discussed and negotiated to avoid any misunderstanding at a later stage. Negotiations require an understanding of the cultural and legal background of the parties.

Before signing a Joint Venture Agreement the following must be properly addressed:

The Joint Venture agreement should be subject to obtaining all necessary governmental approvals and licenses within specified period.

When you decide to create a joint venture, you should set out the terms and conditions in a written agreement. This will help in preventing any misunderstandings once the joint venture is up and running.

A written agreement should cover:

You may also need other agreements, such as a confidentiality agreement to protect any commercial secrets you disclose.

It is essential to get independent expert advice before any final decisions are taken - contact your local Business Link as a starting point for advice.

A clear agreement is an essential part of building a good relationship. Consider these ideas:

Your business, your partner's business and your markets all change over time. A joint venture may be able to adapt to the new circumstances, but sooner or later most partnering arrangements come to an end. If your joint venture was set up to handle a particular project, it will naturally come to an end when the project is finished.

Ending a joint venture is always easiest if you have addressed the key issues in advance. A contractual joint venture, such as a distribution agreement, can include termination conditions. For example, you might each be allowed to give three months' notice to end the agreement. Alternatively, if you have set up a joint venture company, one option can be for one partner to buy the other out. The original agreement may typically require one partner to buy out the other.

The original agreement should also set out what will happen when the joint venture comes to an end. For example:

Even with a well-planned agreement, there are still likely to be issues to resolve. For example, you might need to agree who will continue to deal with a particular customer. Good planning and a positive approach to negotiation will help you to arrange a friendly separation. This improves the chances that you can continue to trust each other and work together afterwards. It can also raise your profile in the business community as a reliable and productive partner.

Collaborative lawyers trust the wisdom of the group; lone wolves and isolationists do not do any good anymore.