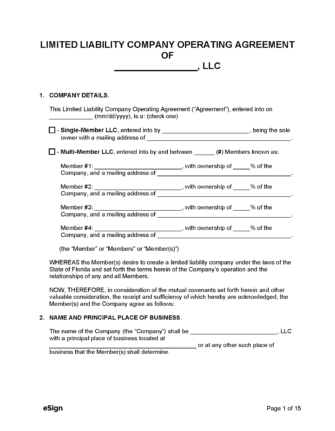

A Florida LLC operating agreement is a legally binding contract that establishes the rules, regulations, and ownership structure of a limited liability company. Although it’s not mandatory in Florida, business owners should create an operating agreement to specify who the founding members are, how much each person invested in the company, where and when meetings will be held, and how profits will be distributed amongst the owners.

An operating agreement also prevents the company from being mistaken as another entity type. Unlike an LLC, the owners of a partnership or sole proprietorship are personally liable for the entity’s debts and obligations.

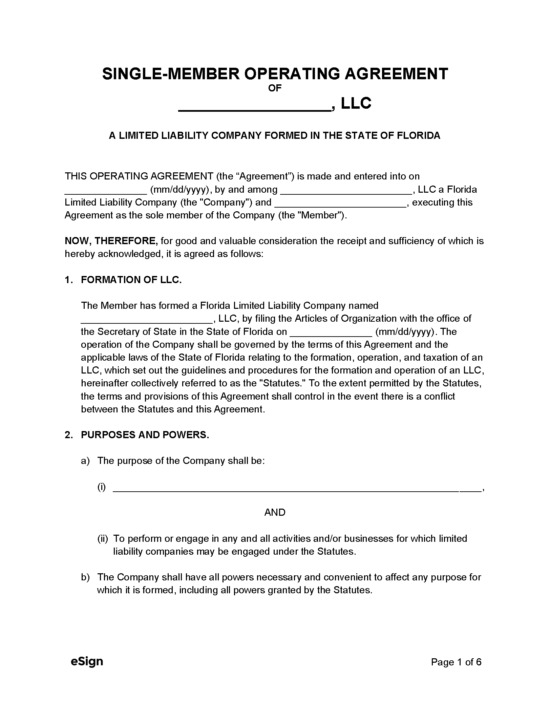

Single-Member LLC Operating Agreement – This agreement spells out the rules and regulations of an LLC with only one (1) member.

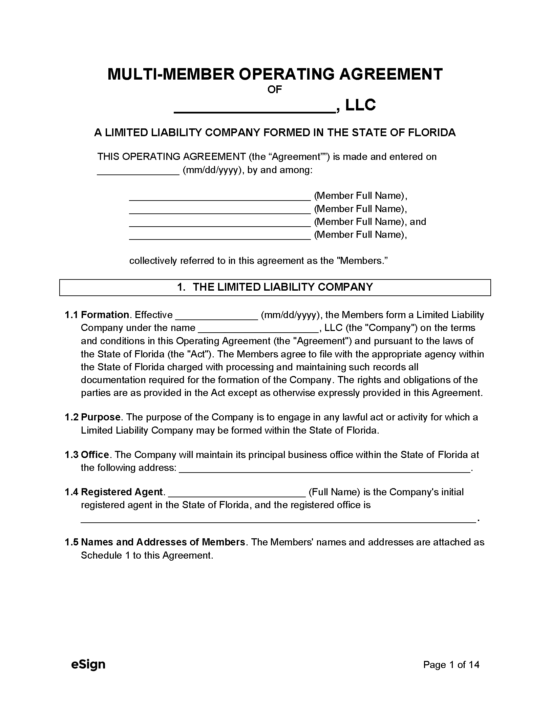

Multi-Member LLC Operating Agreement – LLCs with multiple members may draft this operating agreement to define the company’s internal policies and ownership structure.

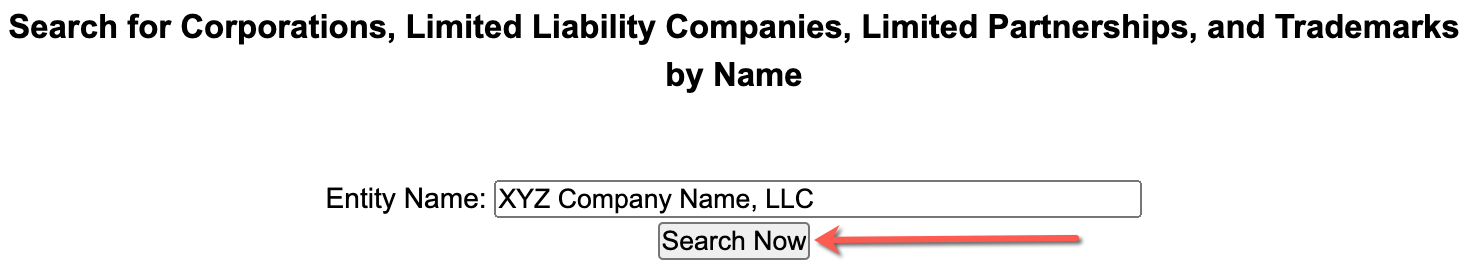

Before attempting to form an LLC in Florida, the person creating the business should check the availability of the entity’s name. Search the Division of Corporations’ records to see if another business has already taken the proposed name.

The name of an LLC must comply with Florida statute § 605.0112. According to this law, the company name must contain one (1) of the following words or abbreviations: “limited liability company,” “LLC,” or “L.L.C.”

If an LLC intends to conduct business using a name other than the one recorded with the Division of Corporations, a fictitious name will be required. For example, an LLC with the legal name of “John Smith Industrial Painters” may wish to operate under a different name for branding purposes. So, the LLC could register the fictitious name of “Painting Done Quick.”

Each LLC is required to designate a registered agent, which is an individual or legal entity that accepts mail and service of process (court-issued paperwork) on behalf of the LLC. In Florida, a registered agent must meet the following requirements:

Note: The LLC cannot serve as its own registered agent, but anyone within the company can be the registered agent.

In order for an LLC to transact business legally in Florida, it will need to register with the Division of Corporations and pay a $125 fee. Registration documents can be submitted online (domestic entities only), through the mail, and in person.

As with most other states, Florida LLCs do not have to create an operating agreement, although drafting one is highly recommended. An operating agreement allows the entity to establish its membership structure and define the rules and regulations of the company.

A nine-digit number known as an EIN, or Employer Identification Number, is given to business entities by the IRS for tax identification and reporting purposes. While an EIN isn’t required for all LLCs, it will be needed if the company wants to hire employees, obtain a loan, or apply for business licenses.

An EIN can be applied for online (select Apply Online Now) or through the mail by filing Form SS-4.

LLCs will need to file an annual report to maintain an active status with the Division of Corporations. The first annual report is due between January 1st and May 1st on the year following the year of formation/registration. Reports must be filed online and will require a $138.75 filing fee.

Filing Options: Online, Mail, & In-Person

Costs:

Forms:

Links: