In this article, you’ll learn about profit and loss statements and find tips on using an income statement for your financial strategy, including expert advice for small businesses. Plus, we’ll guide you through writing a P&L statement.

A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. It captures how money flows in and out of your business.

A profit and loss statement is also called an income statement, a statement of profit, or a profit and loss report. Creating one is a standard way to compile historical data for your business to tell its financial story over time. Each monthly or quarterly reporting period, analyze the data vertically to see your business's monetary resource allocation. Over time, you will also analyze the data horizontally in context with other profit and loss statements to help you to make informed financial decisions and forecasts. You can also use the same technique to understand other businesses' finances.

You need a profit and loss statement to make the most informed choices for your business strategy. As an honest reflection of how your money works in your business, the statement shows what changes need to happen to increase profit.

Ivanka Menken, Managing Director and Co-founder of The Art of Service, emphasizes the importance of a P&L statement: “The numbers don't lie. [A profit and loss statement is] important to truly understand your business’s revenue and profit numbers to know if your revenue is helping or hurting your profitability. Many businesses go broke, especially when the focus is solely on revenue, [and not on] the cost of sales or the profitability of activities.”

A profit and loss statement helps you see exactly how money flows into your business, where you spend that revenue, and what adjustments you need to maximize profit. For example, you may discover that your cost of goods sold (COGS) is too high and needs to be reduced with a less expensive production option. By making changes to improve your margins, you can increase net revenue for the following months. Once you implement the new plan, you can measure its impact over time with the data from future P&L statements.

Additionally, a P&L statement is necessary to prove that your business is a trustworthy, solid investment. Financial backers or investors contributing capital to the business, banks at which you’re applying for a loan, or buyers interested in the business can use the document to determine your business’s capability to make a profit and view your financial trends over time. Essentially, the profit and loss statement showcases your ability to identify complex business problems and articulate how you solved them from a financial standpoint.

Profit and loss statements show your business health over time. A reported loss signals that something isn’t functioning correctly within the business. After analyzing the document, you can pinpoint the cause of the loss and develop a stronger business strategy.

When comparing the statements in the context of other periods, you can clearly identify business areas that are performing well and those that need to be optimized.

Pam Prior, speaker, podcaster, and creator of Profit Concierge, shares an essential tip: “Do something with the information. Knowing history for history’s sake doesn’t do much for you.” Once you record, report, and analyze the information based on 12 months of history, you can use formulas to project the next 12 months. Your P&L statements are the basis of financial forecasting for the following year.

Your income statement is the most important financial statement for your business. Use it, along with one of our free small business budget templates, to simplify and strengthen your small business financial planning.

A profit and loss statement contains three basic elements: revenue, expenses, and net income. More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Basic income statements contain the following elements:

Pro Tip: Menken advises that companies avoid getting too detailed and granular when creating a profit and loss statement, as doing so can defeat the document’s purpose.

Preparing a profit and loss statement involves two multi-stage steps. First, find your gross profit by subtracting your COGS from your gross revenue. Then, subtract your total expenses from the gross profit to calculate the net income.

Before you start, gather the necessary documents. For a basic P&L statement, you only need your credit card and bank account statements. Supplement these documents with invoices, receipts, and other transactions not listed on your credit card or bank statements.

To get started, you’ll need to know the basic formulas. Use our quick-reference guide below until you are familiar with the formulas. We’ve also indicated when to use each formula in our step-by-step instructions for preparing a basic profit and loss statement.

You can calculate your gross profit by taking the sum of the gross revenue and subtracting the COGS. These figures are pre-tax amounts. Use the following formula to find the gross profit:

Gross Profit = Gross Revenue - COGS

Pro Tip: Menken recommends that businesses look at the income and expense lines and consider if they are a cost of sales or an expense. Understanding the difference will help you know where you can save money (by lowering your expenses) and where you need to increase investments to increase revenue.

In this example, since we are preparing a basic small business profit and loss statement, we will simplify the expenses by including the operating and non-operating expenses.

Note: As your business grows and becomes more complex, so will your financial documents. You may wish to expand your income statement to itemize the EBIT or EBITDA separately as a way to compare your business profit with competitors.

The final step is to calculate the net income (also called net earnings) using the following formula:

Net Income = Gross Profit – Total Expenses

Pro Tip: Menken advises, “If you feel overwhelmed by all these numbers, then make it simple. Take the aggregate numbers for your income, cost of sales, and expenses. You’ll then have a five-line overview of your business. From there, you can drill down into more detail when you are ready for more information.

To help you create a profit and loss statement, we’ve filled out a free small business profit and loss statement as an example. Download the fully customizable example template to see how the numbers work and fill in your own figures.

You can also visit our profit and loss templates page to find the free template that best meets your needs.

Businesses routinely prepare a profit and loss statement each month, quarter, or year. As a standard, many organizations prepare the statement monthly to line up with bank cycles.

Pam Prior highly recommends monthly statements: “The standard is monthly because banks tend to cycle each month. Essentially, you’re taking the info from the bank and credit card statements and putting it into a format to see what you made and what you spent. When you do this monthly, you have 12 data points over the course of a year, versus four quarterly or one annual report. Since data informs decisions, 12 points of data provide the most clarity.”

Startups and new businesses that do not have a financial history use a pro forma financial statement instead of a profit and loss statement. The pro forma is a projection of finances and is necessary when you are applying for business financial backing.

To read a profit and loss statement, you must first identify the preparation method: accrual or cash basis. Next, scan the document to review the finances during a single period. Then, analyze the trends over time by comparing data from other P&L statements.

Preparers typically use one of two primary reporting methods on the income statement:

The accrual method is most common in publicly traded companies and is more accurate in reporting the overall health of the company. The cash method is common for personal finances and small businesses and is much simpler, especially when you’re starting out.

Pro Tip: Prior urges new businesses to start preparing income statements using the cash basis method.

To determine the profit margin, we’ve detailed the common formulas and how to use them with your income statement data below:

A vertical or common-size analysis is a financial tool analysts use to interpret financial documents like a profit and loss statement. The method calculates major line items (gross profit, operating profit, and net profit) from your income statement as a percentage of its base line item (gross revenue). These percentages are called margins. Analyzing the document using profit margins allows you to understand the impact of each reporting period for your business, and also produces relative terms to accurately compare your company’s finances to other companies, regardless of their scale.

Net Profit = [(Gross Revenue – COGS) - (operating expenses + taxes, interest, depreciation, amortization)]

[($20,000 - $15,000) – ($1,000 + $500)] = $3,500

After analyzing the document vertically, compare the statements month to month (or quarter to quarter or year to year) horizontally to see the story of where the money is going. Place your net profit margins on a graph to see the information in context. You’ll discover big-picture insights, general business trends, and increasing or decreasing profit margins. You can use this information to forecast your business direction and compare it with other companies’ public financial statements.

Financial expert Prior says, “The really cool thing is when you see a profit and loss statement in columns that show each month. This system shows your financial story over time. This way, you can see if the money you’re spending is working for you and generating revenue — profit is the whole point of business. Once you have this piece in place, you can make informed decisions on what to do next. You’ve got the data to interpret, develop a strategy, and measure its impact.”

Beyond the basic steps of reading and analyzing a P&L statement, it is important to keep outside factors in mind to develop insights for your strategy. Read your profit and loss statement like you would a story. Ask questions when something isn’t adding up as expected. As you read the statement, consider in your strategy the following factors:

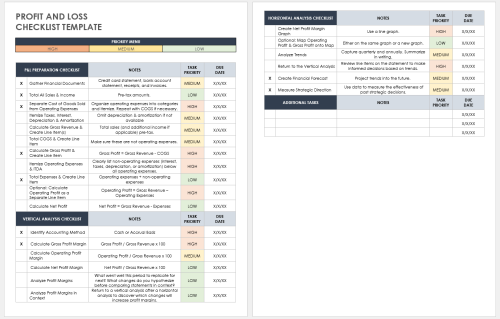

Download Free Profit & Loss Statement Checklist

Microsoft Word | Adobe PDF | Google Docs

Whether you are just beginning to prepare your profit and loss statement or are analyzing profit and loss statements vertically or horizontally, use our quick reference checklist to ensure you don’t miss a step. This complete checklist includes quick reference income statements and profit margin formulas to help you cover all your bases.

A balance sheet is different from a profit and loss statement. It captures a snapshot of the business’s assets, debts, and equity in a single moment, whereas a P&L statement demonstrates the performance of the overall business.

Pam continues, “A profit and loss statement tells you what happens over a period of time. A balance sheet is a record or a snapshot in time as of a certain date, of the values of the things in the business. It’s critical to know if something belongs on a balance sheet or a profit and loss statement.”

All balance sheets calculate the owner’s (or shareholder) equity by assessing the company assets against its liabilities:

The balance sheet is also a supporting document when creating a cash flow statement. The cash flow statement is another financial document that monitors cash flow in and out of the business, sufficient funds for bills, and how well the business generates money.

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today.